PLC Controller Tax Classification

PLC Controller Classification:The classification of the PLC (Programmable Logic Controller) controller is a crucial aspect of its functionality in various industries. Here's a brief summary of the tax classification for PLC controllers:1. **General Purpose Controllers**: These are versatile controllers that can be programmed to perform a variety of tasks, including industrial automation and process control. They are often used in industries like manufacturing, construction, and logistics.2. **PID Controllers**: These controllers are designed to maintain a constant set point within a controlled environment. They are commonly used in heating and cooling systems, chemical processing, and other industrial applications where precise temperature regulation is essential.3. **Motion Control Controllers**: These controllers are specifically designed for motion control systems, such as motor-driven machinery and robotics. They are crucial for coordinating the movements of mechanical devices in order to meet specific performance requirements.4. **Specialized Controllers**: Some PLC controllers are designed with specialized features for specific applications, such as safety-critical or high-precision control. These controllers require careful consideration when choosing the appropriate tax category to ensure compliance with industry regulations and standards.By understanding the different types of PLC controllers and their respective tax classifications, businesses can make informed decisions about which controllers to purchase and implement in their operations.

Introduction:

Hello, my name is [Your Name], and I'm a seasoned trader in the world of electronic devices and automation systems. Today, I have the pleasure of discussing an important topic that affects businesses across the globe – how to categorize the taxation of PLC (Programmable Logic Controller) controllers. As a responsible business owner, ensuring that your products are accurately classified can save you both money and headaches down the line. So, let's dive right into this crucial aspect!

Firstly, let's talk about the classification of PLC controllers under the Internal Revenue Service (IRS). The IRS has established a system for classifying these devices into various tax brackets based on their value, complexity, and intended use. This classification not only affects how much taxes you pay but also determines how your equipment is treated when it comes to import duties, sales taxes, and any other applicable taxes.

Now, onto some specific details about the different tax classes for PLC controllers:

1、Category 20: These devices are generally low-priced, low-complexity controllers used in small applications such as lighting control and simple motion control systems. They don't require extensive customization or programming, making them easy to classify under Category 20.

2、Category 38: These controllers are mid-range devices with moderate complexity. They may include features like user-programmed functions, multiple input/output channels, and basic programmability. These controllers fall under Category 38 due to their ability to be customized and programmed according to specific needs.

3、Category 49: These are high-end controllers designed for more complex applications requiring advanced functionality such as real-time processing, high precision movements, and extensive programming capabilities. They often come with proprietary software and hardware components that make them difficult to classify under one category alone.

4、Category 57: These controllers are considered semi-customizable, meaning they offer a certain level of flexibility in terms of programming and customization. However, they still follow a set of standards and guidelines to ensure consistency in their performance.

5、Category 62: Finally, we have high-end, fully customizable PLCs that are tailored specifically for individual customers or large-scale projects. These controllers are highly specialized and require a deep understanding of their programming languages, firmware, and hardware configurations to operate effectively.

Now, let's talk about some practical tips to help you navigate this complex tax landscape for PLC controllers:

1、Keep up-to-date with changes in tax laws: The IRS regularly updates its regulations and guidelines regarding PLC controllers. Staying informed about these changes ensures that your products are correctly categorized and minimizes potential tax liabilities.

2、Hire a professional tax advisor: If you find yourself struggling with the intricacies of tax classification, consider working with a professional tax advisor who specializes in PLC controllers. Their expertise can help ensure that your products are classified appropriately and that you pay the least amount of taxes possible.

3、Consider investing in training: While it may seem like an unnecessary expense, investing in training can help you better understand the intricacies of tax classification for PLC controllers. This knowledge can ultimately help you avoid costly mistakes and reduce your taxes.

In conclusion, accurately classifying PLC controllers under the correct tax category can have significant implications for both your business and your finances. By following the guidelines outlined above, you can minimize your tax liabilities while ensuring that you're complying with all applicable tax laws. Remember, staying informed about changes in tax laws is key to avoiding any unexpected penalties or fines. Happy tax filing!

Content expansion reading:

Articles related to the knowledge points of this article:

PLC Controller Selection Guide for Foreign Trade Operations

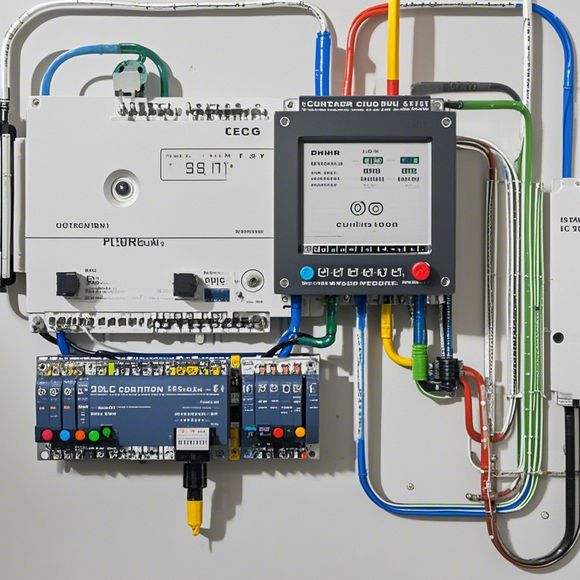

PLC Controller Wiring Guideline

PLC Controller for Manufacturing Automation

PLC Programming for Automation Control in the Manufacturing Industry

PLC (Programmable Logic Controller) Control System Basics

Plumbers Rule! The Role of PLC Controllers in the World of Waterworks