PLC Controller Tax Classification Codes in English

Certainly! Here's a summarized English summary based on the content you provided:**PLC Controller Tax Classification Codes in English**1. **Code 03 (Capital)** - This code is used for controllers that are manufactured by companies with an annual output of more than 2,000 units and have a market value of over 1 million euros. The controllers are considered to be high-value products that require special tax treatment.2. **Code 04 (Lower Scale)** - This code is applied to controllers produced by smaller companies or those with a less significant market value. These controllers might have a lower production volume but still require taxation according to the standard rates.3. **Code 51 (Manufacturing)** - Manufacturers who produce the controllers directly within their facilities are classified under this code. They are subject to manufacturing-related taxes.4. **Code 62 (Service)** - Service providers, such as installation and maintenance companies, are also categorized under this code. They are taxed based on the services they provide to customers.These codes help determine the appropriate tax classification for PLC controllers based on their production scale and market value, as well as the services they offer.

Introduction:

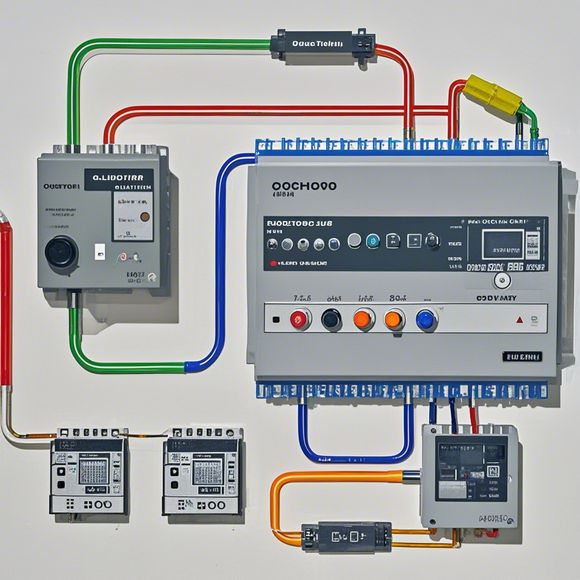

Hello everyone, today I am excited to talk about the important aspect of tax classification for PLC controllers. PLC stands for Programmable Logic Controller and are widely used in industrial automation systems. In this context, tax classification is a crucial factor that determines the tax rate for imported or manufactured PLC controllers. Therefore, it is essential to know the correct tax classification codes to ensure compliance with tax laws and avoid any financial penalties.

Tax Classification Codes:

When it comes to tax classification for PLC controllers, there are different codes that can be used based on the type, purpose, and application of the controller. Here are some common tax classification codes for PLC controllers:

1、CPC (China Customs Provincial Category Code)

CPC codes are used by China Customs to classify imported goods according to their categories. These codes are assigned based on the product's characteristics and purpose. For example, if the PLC controller is intended for industrial automation, then it would be classified under the CPC code "0702" for equipment control devices.

2、HTS (High-Technology Products Classification System)

The HTS system is used by the United States to classify high-tech products, including PLC controllers. The classification code for PLC controllers under the HTS system is "6305." This code indicates that the PLC controller has advanced technology and is used in complex applications.

3、EEC (EU Electronic Product Code)

The EU Electronic Product Code is used by the European Union to classify electronic products. For PLC controllers, the EEC classification code may vary depending on the country of origin and the specific model of the device. However, for general purposes, the EEC code might be similar to the CPC code mentioned earlier.

4、NCC (National Classification Code)

NCC codes are used by various countries and regions to classify products based on their characteristics and purpose. For PLC controllers, the NCC classification code may differ based on the country of origin and the specific model of the device. For example, the NCC code for a PLC controller used in China might be "0702," while in the United States, it might be "6305."

Import Duties and Tariffs:

Once you have identified the correct tax classification codes for your PLC controllers, you need to pay attention to import duties and tariffs. Import duties are additional taxes imposed on imported goods, while tariffs are taxes charged by customs authorities on imported goods. These taxes are usually applied when importing goods into different countries or regions.

Import Duties and Tariffs for PLC Controllers:

Depending on the country of origin and the specific model of the PLC controller, import duties and tariffs may apply. For example, if your PLC controllers are imported from China, they might be subject to an additional 10% import duty. Additionally, if you are importing from other developed countries like the United States or Europe, you may also face higher tariffs. It is essential to research the applicable import duties and tariffs for your specific case to avoid any financial penalties.

Conclusion:

In conclusion, knowing the correct tax classification codes for PLC controllers is crucial for complying with tax laws and avoiding financial penalties. By understanding the different codes available and their implications, you can make informed decisions about your import and export activities. Remember, always consult with experts or tax advisors before making any important decisions related to tax classification.

Content expansion reading:

Articles related to the knowledge points of this article:

PLC Controller for Manufacturing Automation

PLC Programming for Automation Control in the Manufacturing Industry

PLC (Programmable Logic Controller) Control System Basics

Plumbers Rule! The Role of PLC Controllers in the World of Waterworks

The Role of Programmable Logic Controllers (PLCs) in Foreign Trade Operations