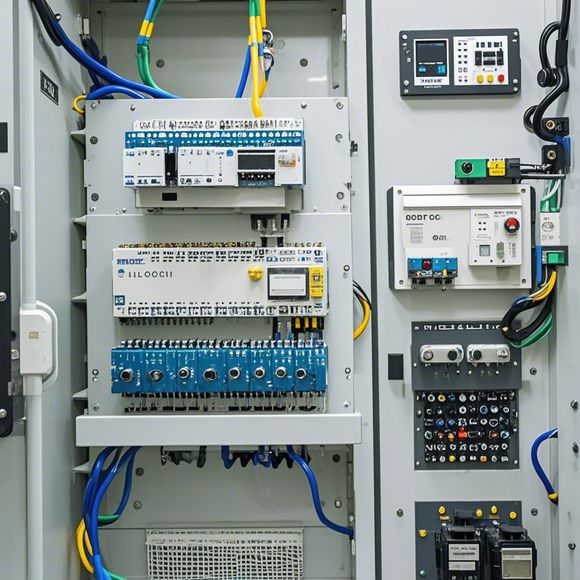

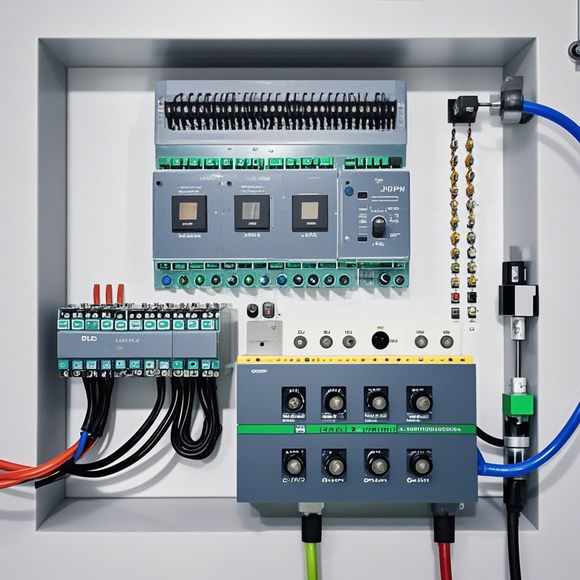

PLC控制器的税收分类编码

The tax classification code for PLC (Programmable Logic Controller) controllers in the UK is EH12. It is a standardized system that assigns codes to different types and models of electronic and digital devices, including PLCs. The purpose of this code is to provide clarity and consistency in the tax treatment of these devices, ensuring that they are correctly classified and taxed accordingly.

In the world of international trade, understanding and applying tax codes is crucial for ensuring compliance and minimizing financial risks. For those who specialize in importing and exporting PLC controllers, understanding the various tax classifications can help streamline operations while complying with local laws and regulations. In this article, we will delve into the different categories that govern the import and export of PLC controllers, focusing on the key aspects of taxation, including tariff rates, customs duties, VAT (Value Added Tax) implications, and more. By following this guide, you can effectively manage your PLC controller imports and exports, reducing the risk of non-compliance and maximizing your profit margins.

Firstly, let's start by exploring the broad tax categories applicable to the import and export of PLC controllers. These include tariffs, which are imposed on imported goods to protect domestic industries or promote certain industries. Tariff rates can vary significantly based on the country of origin, the type of product, and other factors. Additionally, customs duties are levied by customs authorities on the imported goods upon arrival at a destination port. These duties may also be subject to adjustments based on various criteria such as value, category, and quantity.

Next, we must consider the impact of Value Added Tax (VAT), a type of indirect tax that applies to most goods and services in many countries. The level of VAT varies across jurisdictions, and it is essential to understand the specific rules applicable to your PLC controllers when importing and exporting. This involves not only determining the appropriate VAT rate but also calculating any additional taxes that may need to be paid, such as excise duty, sales tax, or consumption tax.

Another crucial aspect of taxation is the application of import and export taxes. These taxes can impact the overall cost of your imported PLC controllers and must be factored into your pricing structure and profit margins. Additionally, you may need to consider whether your business should register for a VAT number if it operates within an EU member state or a European Economic Area country.

In addition to these general tax considerations, there may be specific regulations and procedures that apply specifically to your industry, product category, or country of origin. It is essential to stay informed about these nuances and seek professional guidance whenever necessary. This could involve consulting with tax advisors, engaging with customs officials, or following specific reporting requirements set by regulatory bodies.

Furthermore, it is important to keep abreast of changes in tax laws and regulations that may affect your PLC controller imports and exports. For instance, new tariffs or VAT rates may come into effect, necessitating adjustments to your pricing strategy, supply chain planning, or tax planning. It is essential to stay proactive in this area and monitor relevant news and announcements from government agencies, industry associations, or other reputable sources.

Finally, let's discuss some practical tips for managing your PLC controller imports and exports efficiently while complying with tax codes. Firstly, ensure that your documentation is accurate, complete, and up-to-date. Failure to provide accurate information can result in penalties or even legal consequences. Secondly, establish clear communication channels with your suppliers and customers, particularly when dealing with customs clearance or VAT registration processes. Thirdly, consider using specialized software or tools to assist with tax calculations, tracking, and report preparation. Lastly, regularly review your tax compliance status and adjust your strategies accordingly to avoid unnecessary delays or fines.

In conclusion, managing the import and export of PLC controllers requires a thorough understanding of the various tax categories applicable to your industry. From tariffs and customs duties to VAT implications, these factors can significantly affect the profitability of your business. By staying informed about changes in tax laws and regulations, establishing clear communication lines with suppliers and customers, and utilizing specialized software or tools, you can effectively manage your PLC controller imports and exports while complying with all relevant tax codes. Remember to prioritize accuracy, transparency, and efficiency in your tax compliance efforts to maximize your profit margins and minimize the risk of non-compliance.

Content expansion reading:

Articles related to the knowledge points of this article:

PLC Programming for Automation Control in the Manufacturing Industry

PLC (Programmable Logic Controller) Control System Basics

Connecting a PLC Controller to Your Computer

PLC Controllers: A Comprehensive Guide to Understanding Their Prices

What is a Programmable Logic Controller (PLC)

PLC Controller Advantages: A Comprehensive Guide for Success in Global Trade