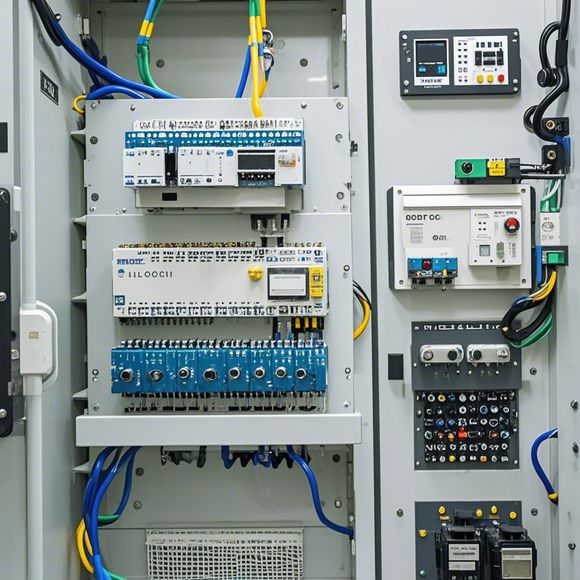

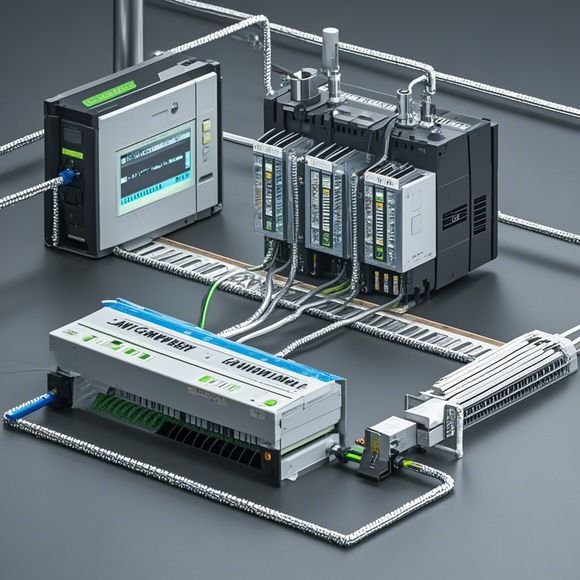

PLC Controllers and Their Tax Classification Codes

PLC (Programmable Logic Controllers) controllers play a crucial role in modern industrial automation. When it comes to tax classification, they're typically categorized as machinery and equipment for the purpose of calculating taxes on imports and exports. The specific codes for PLC controllers depend on their type, complexity, and other factors. Generally, they fall under the category of "electrical machinery" or "electronic equipment," which can be subject to various tariffs and duties depending on the country of origin and destination. It's important for businesses to understand these codes and ensure compliance with international trade regulations to avoid any unintended financial burdens.

Opening line of dialogue (in spoken English):

Hey, everyone! Today, I'm excited to talk about something that's really important to us as a team. We're talking about the tax classification codes for PLC controllers, which can be quite confusing at first glance. So let's dive right in and see how we can navigate through these codes together.

Content expansion reading:

Articles related to the knowledge points of this article:

Smart Manufacturing Solutions with PLC Integrated Machinery

PLC Controller Selection Guide for Foreign Trade Operations

PLC Controller Wiring Guideline

The cost of a PLC Controller: A Comprehensive Analysis

The Role of Programmable Logic Controllers (PLCs) in Foreign Trade Operations