PLC Controller Tax Classification Codes for International Trade

在国际贸易中,PLC控制器的税务分类代码至关重要。这些代码确保了货物在不同国家之间顺畅流通的同时,也遵守了各国关于进出口税收的法律和规定。对于某些特定的电子设备,可能需要按照其功能或用途进行分类,以确定适用的税率。了解这些代码不仅有助于避免潜在的税务问题,还能帮助企业优化其成本结构。通过合理利用这些代码,企业可以确保其产品在国际市场上的价格竞争力,同时符合相关国家的税务法规。PLC控制器的国际交易中的税务分类代码是确保贸易顺利进行的关键。无论是出口还是进口操作,正确理解和应用这些代码都是必不可少的。

In the world of global trade, understanding the complexities involved in import and export can seem like a daunting task. One of the crucial elements to navigate is the tax classification code system used by various countries around the world. This system is designed to classify products and services based on their value-added tax (VAT) rates and other applicable taxes, such as customs duties and excise taxes. As a professional in the field of international trade and logistics, it is essential to understand how PLC controllers fall under these categories and how they are classified accordingly. In this guide, we will explore the intricacies of PLC controllers' tax classification codes and provide insights into the key aspects that need to be considered when dealing with them.

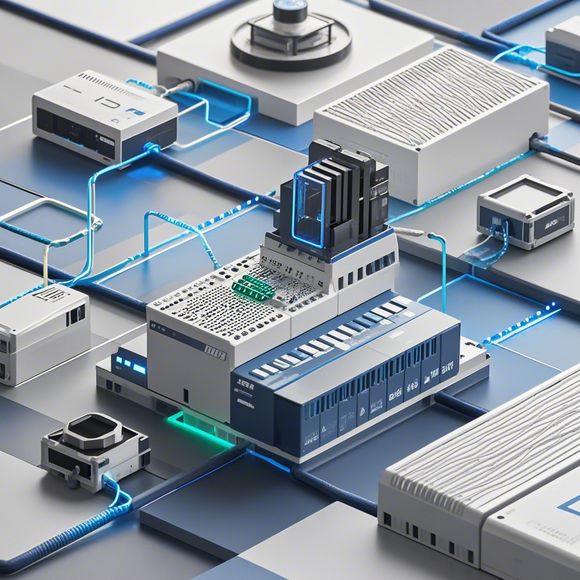

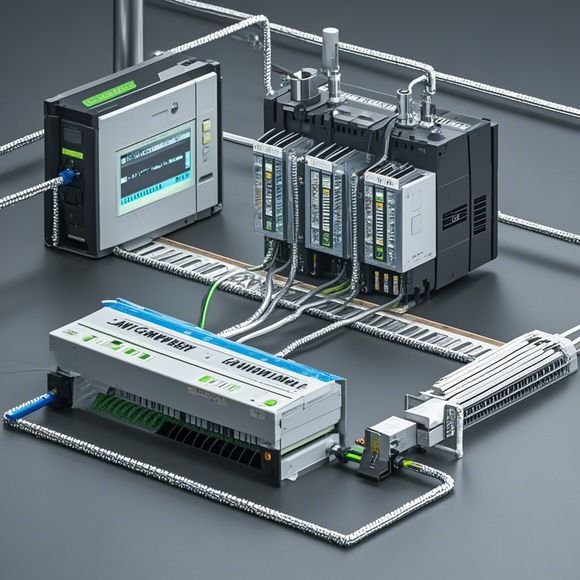

Firstly, let us delve into the basics of PLC controllers and why they are important in today's manufacturing world. A PLC controller, or Programmable Logic Controller, is a device that allows for the automation of industrial processes. It is responsible for controlling various functions within a machine or factory floor, including speed regulation, temperature control, and motion coordination. The importance of PLC controllers lies in their ability to simplify complex industrial processes and improve efficiency, productivity, and safety.

Now, let us turn our attention to the tax classification of PLC controllers. The classification of items is determined by their value-added tax (VAT) rate, which varies depending on the country in which they are sold. For example, in the European Union, there are several VAT rates that apply to different types of goods, including electrical equipment such as PLC controllers. The classification of PLC controllers depends on their type, size, and intended use.

One way to categorize PLC controllers is based on their function or purpose. For instance, if a controller is designed for industrial automation, it may be classified as a General Purpose PLC (GPP), while one designed specifically for motion control might be categorized as a Motor Control System (MCS). Another classification criterion could be based on the level of complexity or sophistication of the controller. For example, a beginner's manual PLC might be classified as a Basic PLD, while a high-end, advanced model might be classified as an Advanced PLD or High-performance PLD (HPL).

Another factor to consider is the type of power source used in the PLC controller. Depending on the country, there may be specific regulations regarding the type and amount of electricity needed to operate a particular model. Therefore, it is essential to check the labeling and packaging of PLC controllers to ensure they comply with local regulations regarding power usage.

In addition to the type and purpose, the size and weight of PLC controllers also play a role in their classification. Larger units may be categorized as Medium or Heavy Equipment (MH/HE), while smaller devices might be classified as Small Devices (SD) or Lightweight Devices (LD). The weight category is important as it impacts the shipping cost, handling requirements, and potential restrictions on import and export.

Finally, another aspect to consider is the availability of spare parts. Some models come with a limited number of spare parts, while others may require extensive repair or replacement parts. This information can be found on the manufacturer's website or through consultation with a sales representative.

In conclusion, understanding the tax classification codes for PLC controllers is crucial for any international trader operating in a foreign market. By carefully analyzing the product's characteristics and compliance with local regulations, traders can ensure that they are not subject to unexpected tax obligations or restrictions. It is always recommended to seek guidance from experienced professionals who specialize in customs clearance and tax laws to navigate the complexities of international trade effectively.

Content expansion reading:

Articles related to the knowledge points of this article:

PLC Programming for Automation Control in the Manufacturing Industry

PLC (Programmable Logic Controller) Control System Basics

Plumbers Rule! The Role of PLC Controllers in the World of Waterworks

Connecting a PLC Controller to Your Computer

PLC Controllers: A Comprehensive Guide to Understanding Their Prices