plc控制器税收分类编码

根据您提供的内容,**PLC控制器税收分类编码是用于标识不同税种、税目和征税方式的编码系统**。PLC控制器的税收分类编码是确保税务正确征收的重要工具。在实际应用中,企业应熟悉并遵守相关的税法规定,确保在开具发票和申报纳税时使用正确的编码,以避免可能的税务违规风险。

"Mastering Plc Controller Tax Classification Codes for International Trade Success"

Hey there, folks! If you're an experienced trader looking to navigate the intricacies of international trade with a plc controller, I'm here to give you the lowdown on how to crack that code and stay ahead of the curve. So grab your notebook and let's dive into some tax classification essentials.

First things first, when it comes to understanding what kind of taxes you'll be tackling with your plc controller, it helps to know where you fall under the purview of the International Trade Administration (ITA) and its various jurisdictions. The ITA has a vast array of codes that determine the applicable tax brackets and rates based on the type of product or service involved.

So, let's break down some common scenarios:

1、Manufactured goods – if your plc controller is used to manufacture products, you might need to deal with excise taxes. For instance, if you’re making electronic devices, you might have to pay sales tax on the entire product or on a specific percentage depending on its value.

2、Services – if you're selling services like consultancy or installation, you're likely subject to a different category of taxes like value-added tax (VAT). This means that every time you make a sale, a portion of it goes straight into your pocket as profit.

3、Exports – if you’re exporting goods, you’ll be dealing with tariffs and other duties imposed by foreign governments. These can vary significantly from one country to another and are often negotiated during the import process.

Now, onto coding – this is where it all starts! You’ll need to identify your plc controller's model number and serial number to get the right classification code. Here's a quick breakdown:

- Model/Serial Number: This is your key to unlocking the tax code. It's like your passport; without it, you won’t be able to get past customs. Just remember that the model/serial number may differ depending on the country you're exporting from or importing into.

- Country: Different countries have their own unique codes for different purposes. For example, if you're exporting to Canada, you'll need to use a Canadian code. If you're importing from China, you may need to use something different altogether.

- Product Type: Depending on the type of product you're exporting or importing, you’ll need to choose the appropriate tax code. Some codes apply only to certain types of products, so be sure to double-check before submitting your paperwork.

Now, back to our chat – once you've identified your tax code, the next step is to familiarize yourself with the tax brackets and rates. This will help you calculate how much tax you need to pay and ensure compliance with regulations.

And don’t forget about VAT – if you're selling services, you'll need to register for VAT. There are different rates depending on the amount of income you generate, so it's important to keep track of these figures.

In conclusion, mastering the intricacies of plc controller tax classification codes is essential for any trader looking to succeed in the global market. By staying up-to-date on the latest regulations and coding systems, you’ll be well-equipped to handle any challenges that come your way. So why not start today? Let's get those numbers crunching and hit the ground running!

Content expansion reading:

Articles related to the knowledge points of this article:

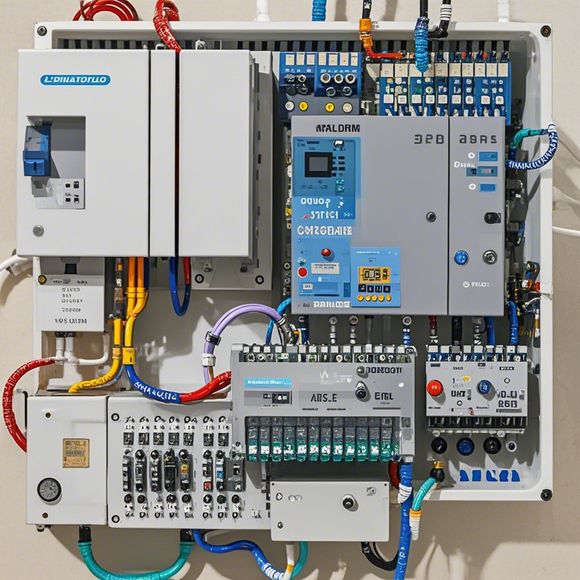

Smart Manufacturing Solutions with PLC Integrated Machinery

PLC Programming for Automation Control in the Manufacturing Industry

How to Use a PLC Controller for Your Business

Plumbers Rule! The Role of PLC Controllers in the World of Waterworks