PLC Controller Tax Classification and COD (Cost of Goods)

Certainly! Here's a brief summary in English:In the world of PLC (Programmable Logic Controller) controllers, tax classification and COGS (Cost of Goods Sold) play crucial roles. Tax classification refers to the process of determining how taxes are applied based on various factors such as income level, source of income, and other relevant criteria. This is important as it determines how much tax needs to be paid by individuals or businesses. On the other hand, COGS refers to the cost of goods sold, which is the total expenses associated with the purchase and processing of materials and services necessary for producing or selling products. It's essential to understand these concepts when managing finances and complying with relevant tax regulations.

Hello everyone, today we're going to discuss about the classification of PLC controllers and their cost of goods (COG). As a professional in foreign trade, it's important for us to understand how these two aspects are related.

Firstly, let's talk about the classification of PLC controllers. There are several types of PLC controllers available in the market, each with its unique features and capabilities. These include programmable logic controllers (PLCs), distributed control systems (DCS), industrial automation systems, and more. Each type has its own characteristics and applications in different industries, such as manufacturing, healthcare, transportation, and more. Therefore, it's crucial for us to select the right type of PLC controller that suits our needs.

Now, let's move on to the COG. The cost of goods refers to the total expenses required to produce or acquire a particular product or service. This includes all the costs associated with the production, transportation, and delivery of the goods. In the case of PLC controllers, the COG includes the cost of materials used in their production, as well as any labor or overhead costs incurred during the manufacturing process. Additionally, we must also consider the cost of shipping the PLC controllers to our customers' locations, as well as any taxes or tariffs imposed by various government regulations.

When it comes to tax classification, there are several key considerations that need to be made. Firstly, we need to determine the appropriate tax bracket for the PLC controllers we are selling. This will depend on the country of origin, the intended use of the controllers, and other factors such as the size of the company or the level of income. Once we have determined the tax rate, we can calculate the total tax amount owed for each unit sold.

Another important factor to consider is customs duty and import/export fees. These are additional charges that may apply when importing or exporting PLC controllers into different countries. Depending on the destination country and the value of the controllers, these fees can significantly impact the COG. It's important for us to keep track of these charges and factor them into our overall COG calculations.

In addition to tax brackets and customs duties, we must also consider any other applicable taxes or tariffs. For example, some countries impose additional taxes or tariffs on certain products, which may affect the final price of PLC controllers sold internationally. We need to research and identify these potential costs before finalizing our pricing strategy.

Lastly, when calculating our COG, we must take into account any possible rebates or discounts offered by our customers or government agencies. These incentives can help us offset some of the costs associated with producing or acquiring the PLC controllers. It's important for us to communicate these benefits clearly to our clients so they can make informed purchasing decisions.

In conclusion, understanding the classification of PLC controllers and their cost of goods is crucial for any successful foreign trade operation. By carefully analyzing the tax bracket, customs duties, and other relevant factors, we can ensure that our pricing strategy accurately reflects the true costs involved in producing or acquiring PLC controllers. Additionally, taking advantage of any applicable tax incentives or discounts can help us maintain competitive pricing while still ensuring profitability.

Content expansion reading:

Content:

Hey there, fellow professionals! Today, we're diving into the world of PLC controllers and the all-important tax classification codes that come with them. Now, I know what you're thinking – tax codes aren't exactly the most exciting topic. But trust me, when it comes to ensuring smooth operations and compliance, understanding these codes is crucial. So, let's get into it!

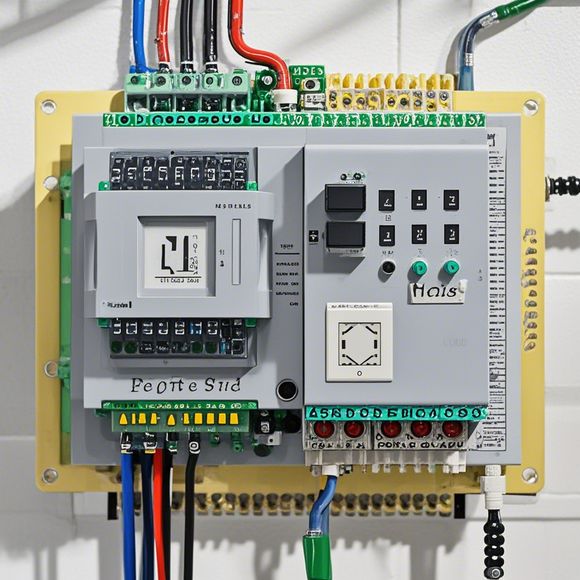

First things first, what exactly is a PLC controller? Picture this: it's the brain of an industrial control system, responsible for monitoring and controlling various processes. From manufacturing plants to power grids, PLCs are the unsung heroes of automation. But when it comes to taxes, they're not all treated the same.

That's where tax classification codes come in. These codes are like secret handshakes between businesses and tax authorities, ensuring that each PLC is taxed according to its specific use and function. It's not just about the hardware; it's about how that hardware is being used.

Now, let's talk about the different types of PLC controllers and their corresponding tax codes. For instance, a basic PLC that's used for simple on/off control might fall under one code, while a more advanced PLC with complex programming capabilities could be classified differently. Each code reflects the value-added features and the role the PLC plays in the overall operation.

But it's not just about the PLC itself; it's also about the peripherals and accessories that come with it. These can include everything from input/output modules to communication cards, and each of these has its own tax implications. It's like a puzzle; you need to understand how each piece fits into the bigger picture to get the tax classification right.

And let's not forget about regional variations. Different countries and even states within a country can have their own tax codes and regulations. This means that as a global or even a local operator, you need to be aware of these nuances to avoid any unpleasant surprises come tax time.

So, how do you navigate this maze of tax codes? Well, it's all about staying informed and working closely with your tax advisors. They can help you understand the specific codes that apply to your PLC controllers and ensure that your operations are optimized for maximum efficiency and minimum tax burden.

In conclusion, tax classification codes for PLC controllers might not be the sexiest topic, but they're essential for running a successful and compliant business. By understanding how these codes work and staying updated on the latest regulations, you'll be able to focus on what really matters – growing your business and staying ahead of the competition.

Remember, knowledge is power, especially when it comes to taxes. So, keep learning, keep adapting, and most importantly, keep your tax game strong!

Articles related to the knowledge points of this article:

The cost of a PLC Controller: A Comprehensive Analysis

How to Use a PLC Controller for Your Business

PLC (Programmable Logic Controller) Control System Basics

Plumbers Rule! The Role of PLC Controllers in the World of Waterworks