PLC Controller Tax Classification and Its Significance in International Trade

The PLC (Programmable Logic Controller) Controller Tax Classification and Its Significance in International TradeIn the world of international trade, understanding the tax classification of a product is crucial. This includes the classification of PLC controllers, which are used in various industries. These controllers come under the category of machinery, electronic equipment, or electrical goods, depending on their specific features and uses.The importance of this classification lies in how it impacts the overall cost of goods sold for companies operating in different regions. For instance, if a company is based in a country with a lower tax rate, they may be able to reduce their overall tax liability by classifying their PLC controllers as machinery instead of electrical goods.Furthermore, the correct tax classification can also affect the level of customs duty and other related taxes that a company has to pay. It's important for businesses to ensure they are accurately classifying their products so they don't end up paying more than they need to in taxes.

Opening Remarks:

Hello, fellow traders! I'm excited to share with you today a crucial aspect of our international business operations - understanding and applying the tax classification of PLC controllers. As we navigate the complex landscape of global trade, it's essential to have a firm grasp on the various taxes imposed on imports and exports. Today, let's delve into the world of PLC controllers, their tax classifications, and how they can impact your business operations.

Introduction:

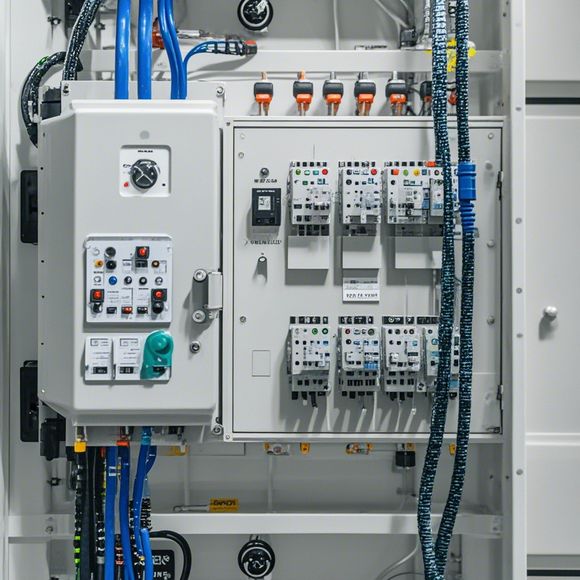

Firstly, let's define what a PLC controller is. A PLC (Programmable Logic Controller) is a powerful tool that automates industrial processes by controlling mechanical or electrical systems. In this digital age, PLCs come in handy for industries ranging from manufacturing to healthcare and more. However, when it comes to taxation, the complexity can be daunting. That's where we come in to help you navigate the intricacies of tax classification for PLC controllers.

Key Points in Tax Classification:

1、General Purpose: This category includes all PLCs used for general-purpose automation applications. They are versatile and can perform a wide range of functions, including control of machinery, production lines, and other industrial systems.

2、Special Purpose: These are PLCs specifically designed for specific tasks like process control, quality assurance, or safety monitoring. They are tailored to meet the unique needs of specific industries, making them highly specialized tools.

3、Industrial Automation: PLCs in this category are designed to work within industrial environments, often in harsh conditions. They are built to withstand the rigors of the manufacturing industry, making them an ideal choice for industrial automation projects.

4、Control Systems: These are PLCs that operate as part of larger control systems. They play a crucial role in managing and coordinating the activities of multiple subsystems and components within an industrial setup.

5、Robotics Applications: PLCs in this category are specifically designed for use in robotic systems. They allow for seamless integration between human operators and robotic machinery, enhancing productivity and efficiency.

6、Field-Based Control: These PLCs are designed to operate in remote locations without a centralized control system. They offer flexibility and scalability that make them ideal for field-based automation projects.

7、Modularity: One of the defining features of modern PLCs is their modular design. This allows for easy customization and expansion, enabling businesses to tailor their automation solutions to specific requirements over time.

Importance of Tax Classification:

The tax classification of PLC controllers has far-reaching implications for both domestic and international businesses. Here are a few reasons why understanding the tax classification of these controllers is crucial:

1、Customs Duties: Knowing the correct tax classification helps businesses avoid unnecessary customs duties and fees. By accurately labeling their products, they can reduce the overall cost associated with customs processing.

2、Tax Credits: Many countries offer tax credits or incentives for companies investing in automation technologies such as PLCs. Knowing the correct tax classification can help businesses claim these benefits effectively.

3、Export Qualification: Depending on the country, PLC controllers may be eligible for export licenses or other exemptions. Being able to correctly classify them can ensure compliance with export regulations.

4、International Trade Compliance: When dealing with foreign buyers or suppliers, having a clear understanding of the tax classification of PLC controllers is essential. It helps establish trust and ensures that transactions are conducted in a fair and transparent manner.

5、Compliance with International Laws: Some countries impose import taxes based on the type and purpose of the goods being imported. Being aware of the tax classification of PLC controllers can help businesses comply with international laws and regulations.

Conclusion:

In conclusion, tax classification is an important consideration for any company looking to import or export PLC controllers. By understanding the key points in tax classification and its implications for businesses, we can streamline our operations, minimize costs, and ensure compliance with international laws while expanding our international markets. Remember, staying up-to-date on the latest tax regulations and best practices is key to ensuring success in today's dynamic global marketplace. So, let's dive deeper into the world of PLC controllers, their tax classifications, and how they can enhance your international trade operations.

Content expansion reading:

Content:

Hey there, fellow professionals in the world of exports and imports! Today, we're diving into a topic that might not be the most exciting, but it's definitely essential for anyone dealing with PLC controllers: tax classification codes. Now, I know what you're thinking – who wants to talk about taxes when we could be discussing the latest trends in automation or the coolest features of the newest PLC models? But trust me, understanding these codes is crucial for ensuring smooth operations and avoiding any unexpected surprises during the import and export process.

So, let's get down to business. What exactly are PLC controller tax classification codes? Well, they're essentially a set of numbers and letters that categorize your PLC controllers for tax purposes. These codes are used by customs authorities around the world to determine the correct tax rate that applies to your product. Each country has its own system, which can be a bit of a headache to navigate, especially if you're dealing with multiple markets.

Why are these codes important? Simple – they can have a significant impact on your bottom line. If you get the code wrong, you could end up paying too much in taxes, or even worse, you might not be compliant with local regulations, which could lead to delays or even penalties. On the flip side, if you understand how to use these codes to your advantage, you can potentially reduce your tax burden and make your products more competitive in the global market.

Now, let's talk about how to find the right tax classification code for your PLC controllers. The process can vary depending on the country you're dealing with, but here's a general guide:

1、Research: Start by researching the Harmonized System (HS) code or the local equivalent for your PLC controllers. The HS code is a standardized system used by most countries to classify goods for customs and tax purposes.

2、Product Description: You'll need to provide a detailed description of your PLC controller. This includes not just the basic function but also any additional features or accessories that might affect the tax classification.

3、Classification: Once you have your product description, you can look up the corresponding tax classification code. This is where it gets a bit tricky, as you'll need to understand the specific criteria used by each country.

4、Customs Rulings: In some cases, you might need to obtain a customs ruling to ensure that your PLC controllers are classified correctly. This is especially true if your product has unique features that don't fit neatly into a standard category.

5、Stay Updated: Tax laws and regulations can change, so it's important to stay informed about any updates that might affect your product's tax classification.

Remember, getting the tax classification right is not just about avoiding penalties; it's also about ensuring that you're not paying more than you need to. By understanding how these codes work, you can make informed decisions that can save your business money and help you stay ahead of the competition.

So, there you have it – a quick rundown on PLC controller tax classification codes. It might not be the sexiest topic, but it's definitely one that deserves your attention. Keep learning, stay informed, and most importantly, don't let the taxman catch you off guard!

Articles related to the knowledge points of this article:

PLC Controller Selection Guide for Foreign Trade Operations

PLC (Programmable Logic Controller) Control System Basics

Plumbers Rule! The Role of PLC Controllers in the World of Waterworks

Effective Strategies for Handling PLC Control System Faults

What is a Programmable Logic Controller (PLC)

PLC Controller Advantages: A Comprehensive Guide for Success in Global Trade